Black Monday to Record Highs - My Tumultuous Love Affair with the Dow📈

E162: How numbers can paint a picture and tell a story, WoP13

The Dow and I

Do you know that feeling when your child or sibling achieves something beyond your wildest ambitions for them? Like hearing the “ding” when they climb the rope in gymnastics and hit that bell? Or see the mud on their clothes after they portaged1 through Algonquin for three days? Well, that is how I feel about the Dow.

The Dow breached another barrier this week. It crossed 43,000.

Now, Dow and I have a rather personal relationship! Dow (aka DJIA / Dow Jones Industrial Index2) and I go all the way back … to 1,738 in my early career on Wall Street. So you can see how I took a moment to be emotional about this particular achievement!

I track the value of the Dow the same way others remember a particular song on the car radio or the price of a gallon of gas. It has tracked against some major moments in my life. So let my numbers tell you some stories:

1,738

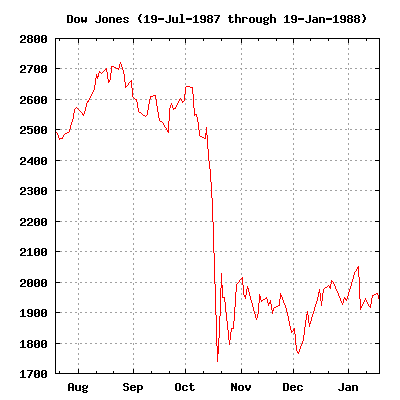

“The Dow Jones Industrial Average (DJIA) falls 508 points (22.6 percent) to 1,738” the New York tabloids would scream in bold 50 size font headlines the next day. It was (and still is) the largest one-day drop by percentage in the index's history, bringing back fears of when the 1929 DJIA dropped 30 points/12% triggering the Great Depression.

I remember Black Monday, October 19, 1987 viscerally. It was my first year on Wall Street and I was in the IT3 department. “Run it again.” We were on the 25th floor of 55 Water Street. Outside the sun shone on the Statue of Liberty and the water sparkled. But inside every head was gathered around my cubicle. It was the closest thing we had to having someone on the floor of the exchange on other end of the phone. In a world ruled by batch4 programming my subroutine reached through Morgan Stanley’s rigid data walls into the outer world to query the “real-time” value of the Dow index. I hit “run” again. And each time we’d scribble the value on the paper on the desk, charting another dramatic drop, jitters would run down my spine. “Would this ever end?”

The Dow would lose almost 25% of its value that day, dropping 508 points from its open at 2,247 to close at 1,738. I recall feeling particularly disturbed and upset on behalf of the young married man sitting opposite me. It was his first day on the job. “I bet he’s questioning if he made the right choice to move from safe boring TelCo into Wall Street!”

It was also the day I understood my puzzle piece in this picture.

My transferable skill was coding. I was a recent import from the UK. I’d come from coding for North Sea oil rigs 5 to do a year’s contract on Wall Street. When I returned to London I might be coding for The City; or Oil and Gas; or for a Defense contract. I’d spent most of my year understanding and digitizing the settlement cycles of US Treasury bills, bonds and notes and Mortgage Backed Securities. A cusip was a cusip was a cusip6, right?

But on this day, I finally began to understand how everything fit together. Even a math-head like me knew about the Great Depression! Watching 25% of the economy wiped out as you hit Enter. Enter. Enter. kinda sticks with you. Suddenly I had context for what I did. It would take over a year for the markets to muck out of this mess, but not before it destroyed housing prices and employment — effects that rippled out globally.

That 500+ point drop would stay with me and become my bellwether for a possible recession and tightening of the belt.

OK. Long story. But it sets the stage.

6,000

Working in IT in the mid-1990s, I had a front-row seat on history. A new technology and way of accessing and sharing information had the potential to change everything. I’d been a part of the strategy team deciding if this was a long-term play or a flash in the pan.

I watched the numbers in the market rise. New to the world of investing my own money and a little gun-shy after my BTS (behind the scenes, not the Korean boy-band) experience years before, I was terrified to trust my meagre pot of hard-earned ‘today’ money to my company-managed pension plan (insider trader regulations). What if it evaporated?

As I was going on maternity leave 3Q1996, and not sure if I would have timely access to a phone to manage my investments, I preemptively pulled my money out of the markets to the safety of cash. All of it.

My baby showed up two weeks early, less than 12 hours after I left my desk. The Dow crossed 6,000 on October 14, 1996.

10,000

The next few years would be a busy blur of babies and work, babies and work. Really exciting work! I was working on strategy, hosting many names that would soon become icons in a still young Silicon Valley, experimenting with new concepts, software and batting around ideas.

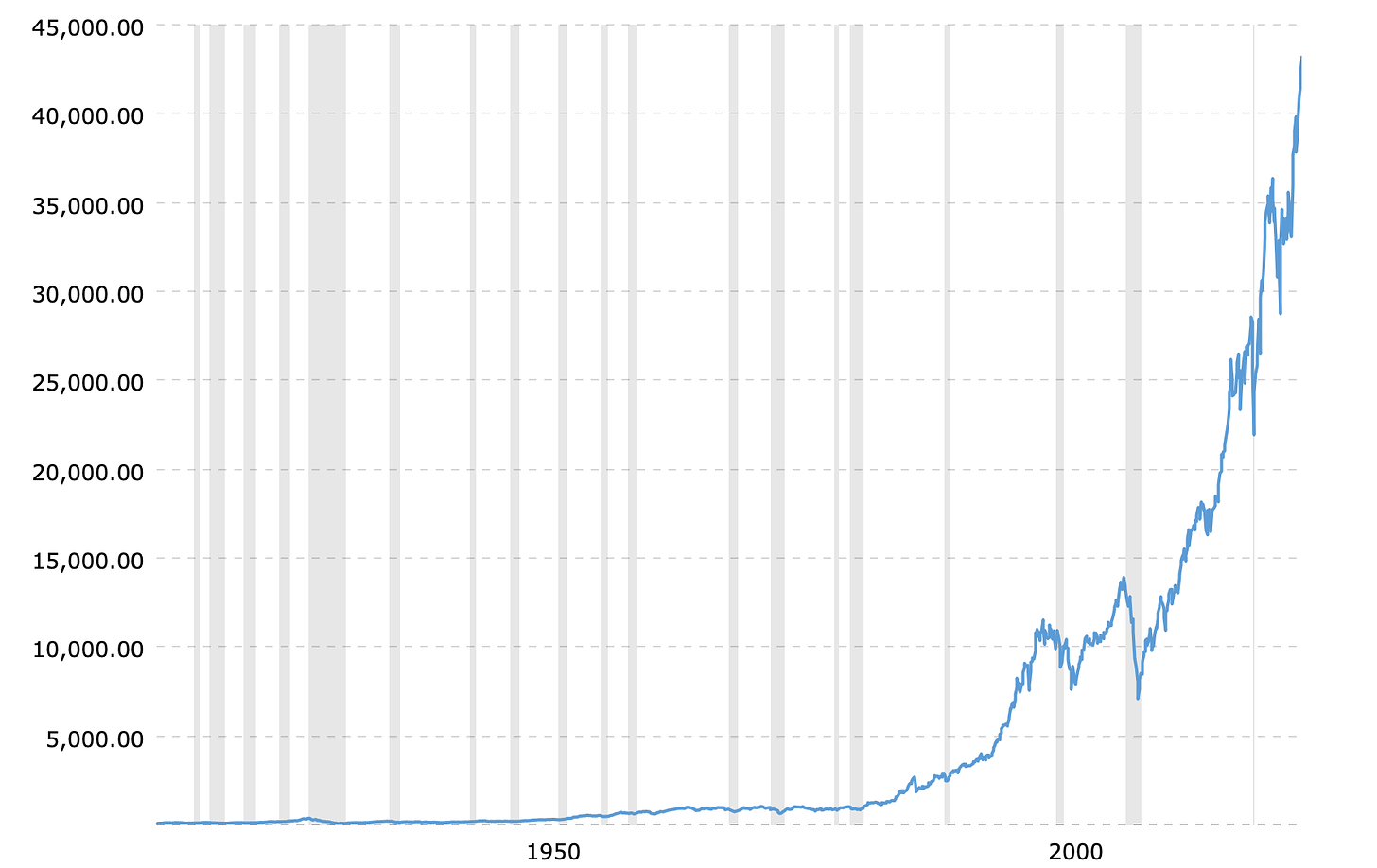

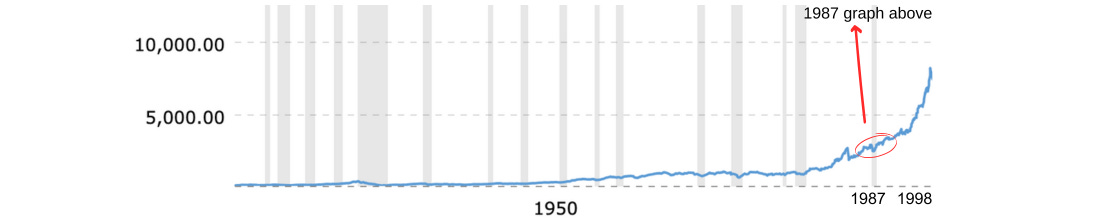

In 1998, as part of an idea to infuse more finance context into the coding mindset across our technology department, my manager suggested something radical. Whatif? What if we commissioned a huge mural for the back wall of the IT cafeteria situated 14 floors above Time Square? I’d just completed a Tufte course on the value of visualizing dry numbers to make them sing their story. The graph hugged the x-axis for most of the wall, then screamed its way upward, like a gigantic hockey stick.

I still recall one Friday afternoon in late 1998. The top IT managers where chatting among themselves, trading updates on their projects. We had an army of coders around the globe working frantically on Y2K mitigation expanding 6-digit date fields created when data storage was expensive, to the YYYYMMDD 8-digit one. Every calculation had to be checked. Another big global team was setting the stage to convert 11 sovereign currencies to the single Euro (EUR) on January 1, 1999. (Yeah, I know! planning much? aka when bureaucrats destroy New Year Eve celebrations for coders)

Eric popped his head into the CIO/CTO’s7 office. “Hey. We may have something else on our hands here. Have you been watching the Dow? Looks like it will soon cross 10,000.” Here we go again. Every program in the entire portfolio had to be remediated and tested to make sure every online and batch calculation field could cope with a five-figure Dow, else bring all our trading operations to a screeching stop.

The Dow crossed 10,000 on March 19, 1999. “Will this growth ever end?” I put my money back into the market.

7,552

Yes. Felt this one too. After starting 2008 at 13,044 I felt every single drop and plummet in my bones as my pension plan followed the index (and all other indices) and tumbled all the way down the slippery, mucky hill — wiping out almost ten years of growth — to 7,552 on September 12, 2008.

Practically every country on Planet Earth felt this in every household. The index lost 33% of its value that year. Many brokerage firms, including many that I had interviewed at, shuttered, merged or reorganized. Everyone knew someone who had lost their job. And ideas like crypto and managed-marketplace firms like AirBnB and Uber started surfacing as everyone tried to leverage the assets they already owned.

But you were there, right? You remember.

43,000

The DJIA crossed 43,000 on Monday, October 14, 2024. I am no longer on Wall Street. I was experimenting with “stuffin’ muffins” to celebrate Canadian Thanksgiving, surrounded by our extended Canadian family.

Over the Dow’s steady rise from 1,738 to 43,000 I have gone from being a party of one to a part of a family of forty.

I had to see the graph that night! As we now live in a world of instant-everything, I got to my screen and hit Enter. And voila:

If they could see me now! 📈

What a perspective. Look at that arc! There is a buoyancy in the markets, even though we feel significant inflation on Main Street. After studying the sequential impact of railroads, oil, automotive, space, finance on the markets, I could not imagine the heights to which a new technology like the internet would create impact. IT moved over from being a cost center to being a profit center for many organizations. Every company now wants to have a tech-sector designation so they could reap those multiples in their stock price.

What will be the next opportunity for growth?

Will this ever end?

In an upcoming essay I’m going to riff off this train of thought and debate where all that wealth got created. And if we have all this wealth in the system can we coalesce and solve some of the big problems (like Climate) out there?

After all, in 1969 we sent man to the moon … and brought him back. There were less than 4 billion brains on Earth, less than 10% of high-school grads went onto post-secondary education in the USA, and the DJIA was valued at 875.

What can we possibly do today, with the abundance of global brain, brawn and wealth we have access to? Let’s imagine …

Meantime …

I bet you, too, have a favourite set of markers for tracking your major life events. What are they?

This essay is another in the series Adulting in Manhattan

Welcome to the many new members of Tribe Tilt, particularly the many who have joined through Write of Passage.

You join a wonderful group that believes we can make a difference to the people and places that are precious to us, and that we have fun, hope and agency in our lives. We believe that the best ideas can come from anyone, anywhere, at any time. Please add your voice to our conversations.

Stay healthy. From there all else becomes possible.

Until next week …

Karena

This is the opening week of Write of Passage WoP13. Thanks to the many eyes that edited and offered suggestions on this essay:

() Amit Bhatia, Mark Connolley-Mendoza (), Nate Gosselin (heynate.me), Dave Pollak, ri dym, , Marie Friberger, , , M. Kareem Griffith, Karen Arden (iamx.one), Meike Hohenwarter (meikehohenwarter.com) [Oh, did I miss you? Apologies - DM me and I’ll make amends]And my regular editing crew:

and .https://en.wikipedia.org/wiki/Portage

What is the Dow Jones Industrial Index? The Dow Jones Industrial Average (DJIA) is a stock market index that tracks 30 large, publicly-owned blue-chip companies trading on the New York Stock Exchange (NYSE) and Nasdaq. The Dow Jones is named after Charles Dow, who created the index in 1896 along with his business partner, Edward Jones. Also referred to as the Dow 30, the index is considered to be a gauge of the broader U.S. economy. https://www.investopedia.com/terms/d/djia.asp

IT = Information Technology, the olde worlde name for Tech.

If you are asking “What is batch?” you must be born after 1995! I feel for you. You are cheated out of having to wait patiently for a child or partner to call from a payphone so you know they got to where they were headed safely. It harks back to a bygone era when we had to wait (and wait and wait) for a sequence of programs to run overnight so that we could find out the value of bank account/stock portfolio/electricity bill etc. Everything right now is a feature of our new technologies, capabilities and the rapidly shrinking cost of storage and information processing.

CUSIP stands for Committee on Uniform Securities Identification Procedures. A CUSIP number identifies most financial instruments, including: stocks of all registered U.S. and Canadian companies, commercial paper, and U.S. government and municipal bonds. [https://www.investor.gov/introduction-investing/investing-basics/glossary/cusip-number]

https://www.macrotrends.net/1319/dow-jones-100-year-historical-chart

https://www.latimes.com/archives/la-xpm-1999-mar-30-fi-22396-story.html

CIO = Chief Information Officer, now more commonly referred to as a CTO Chief Technology Officer.

This is now my favorite non-finance reference to the Dow.

My second-favorite is Rihanna and Jay-Z's Umbrella: Let it rain, I hydroplane in the bank / Comin' down like Dow Jones

We moved many times when I was growing up, so I use the places where we lived to track major life events.